Sage Intacct has the capabilities to automatically use a bank feed to record daily bank sweeps, even across entities within an organization. This is one example of how Intacct can significantly speed up an otherwise manual process and increase accuracy. Additionally, this provides a true cash view for those consolidating bank accounts in real time. In this blog, our president, Eric Ward, walks through the process of setting up the automated bank sweeps within Sage Intacct.

Connecting your bank

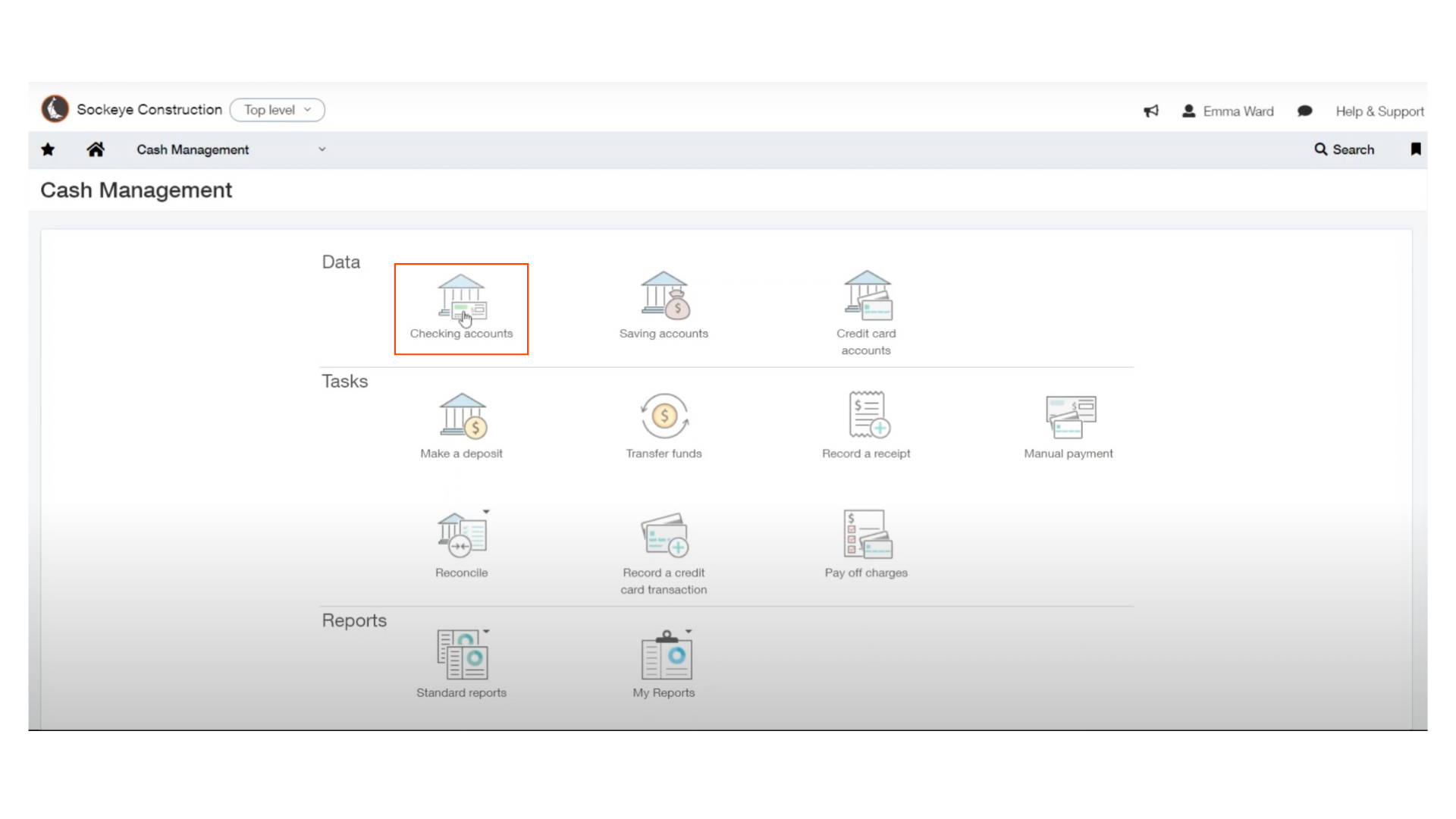

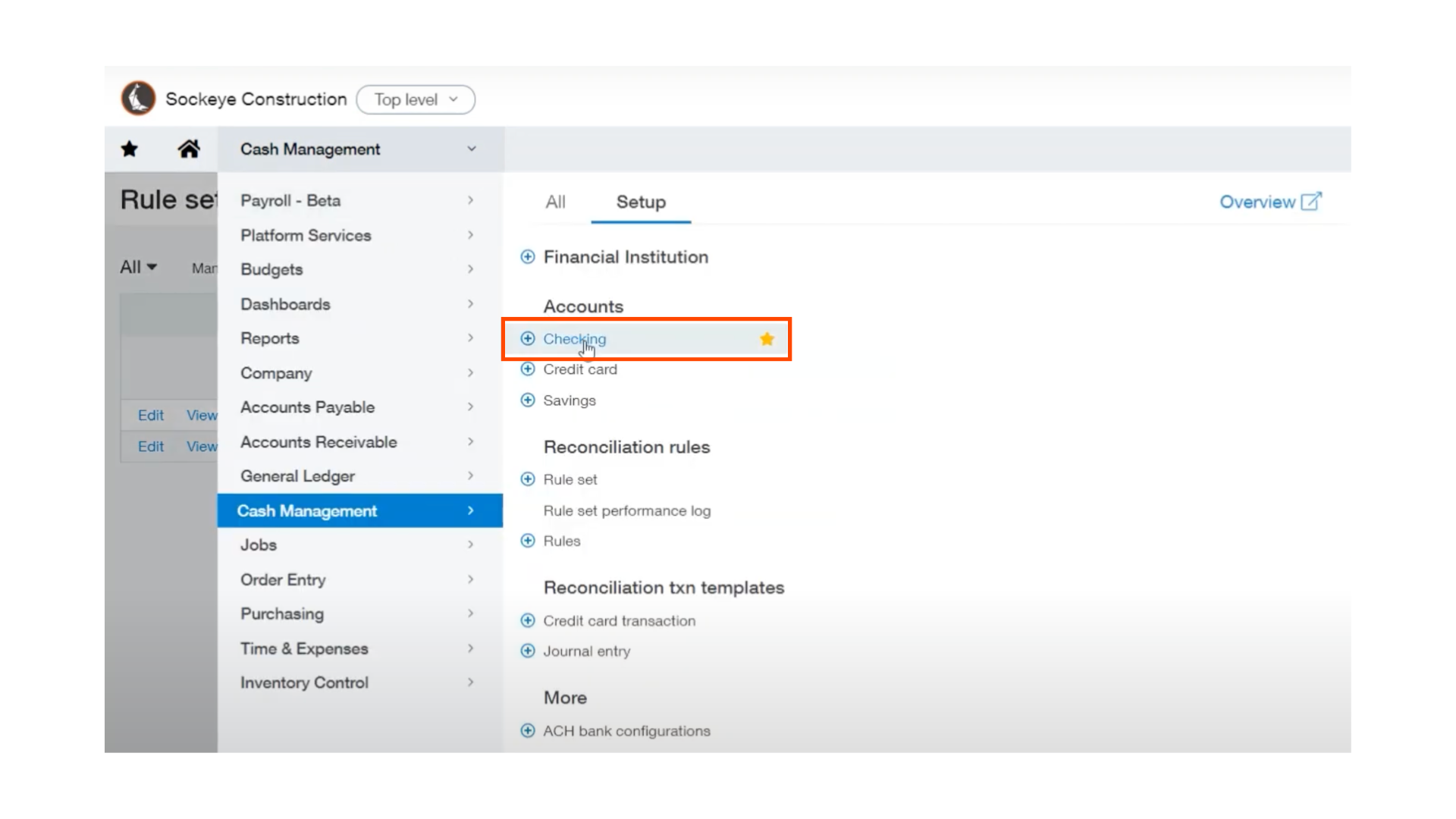

Prior to setting up automatic bank sweeps, it is important to connect your bank. First, go into your checking account within the cash management menu.

For each account you would like sweeps set up, there are several automatic connections you will want to make. Select Edit on the left side of each account, choose the Banking Cloud tab along the top and click Connect.

Edit > Banking Cloud > Connect

Here you will find your bank, sign in, and go through the authentication process, which will result in the connection to your Intacct environment. This connection step is important to do before setting up bank sweeps because it allows for easier identification of potential error sources with the process of bank sweeps.

Once the connection is made, the bank feed will start coming into Intacct about four times a day. When the transactions clear the bank. Sage Intacct will see the transactions and follow any rules that you set up based on those transactions.

Setting up Automatic Recording of Bank Sweeps

Step 1: General Ledger Journals

Navigate to the Intacct menu.

General Ledger > Setup > Journals

Although this step is not required, it is highly recommended. Set up a journal for Bank Sweeps using the symbol ZBA for Zero Balance Account (sweep accounts).

Step 2: Create Transaction Template

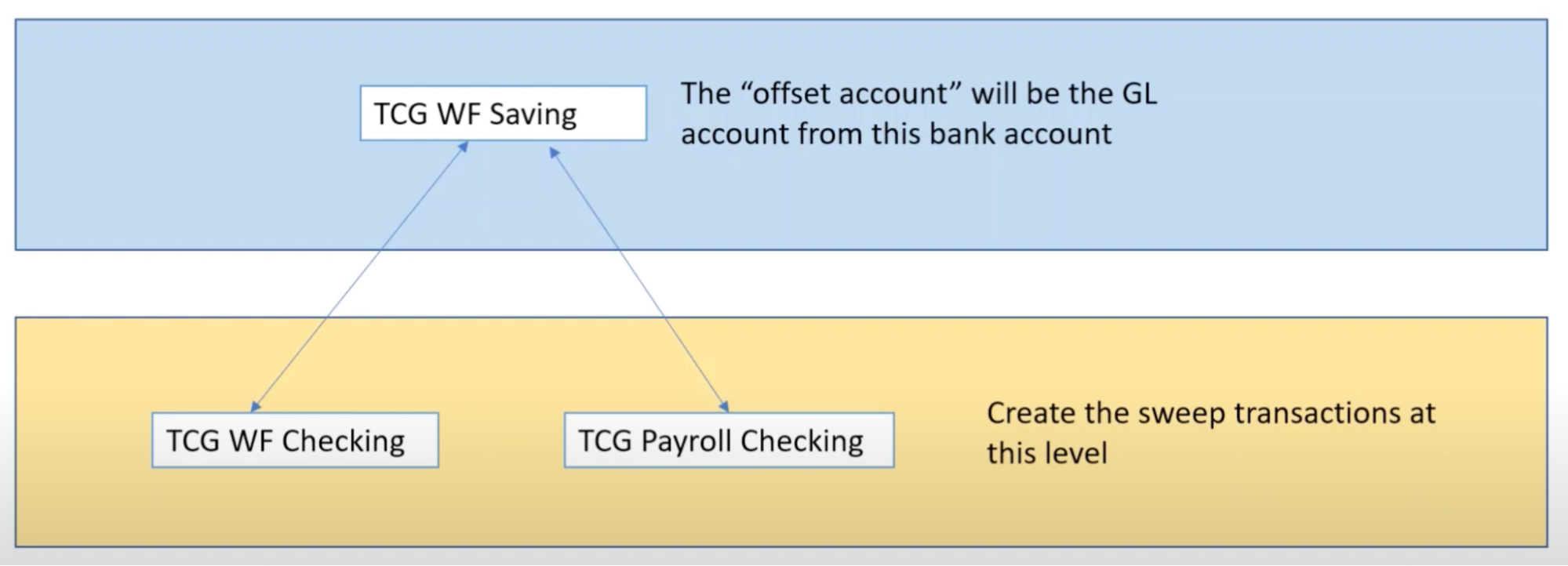

In terms of the layout of the accounts, a simple version could be one savings account and two checking accounts. If you have this setup, a more efficient way to set up the accounts is by creating the sweep transactions at the checking account level. That is because you can set up one rule to assign to both checking accounts so that the offset of that rule will be the savings account.

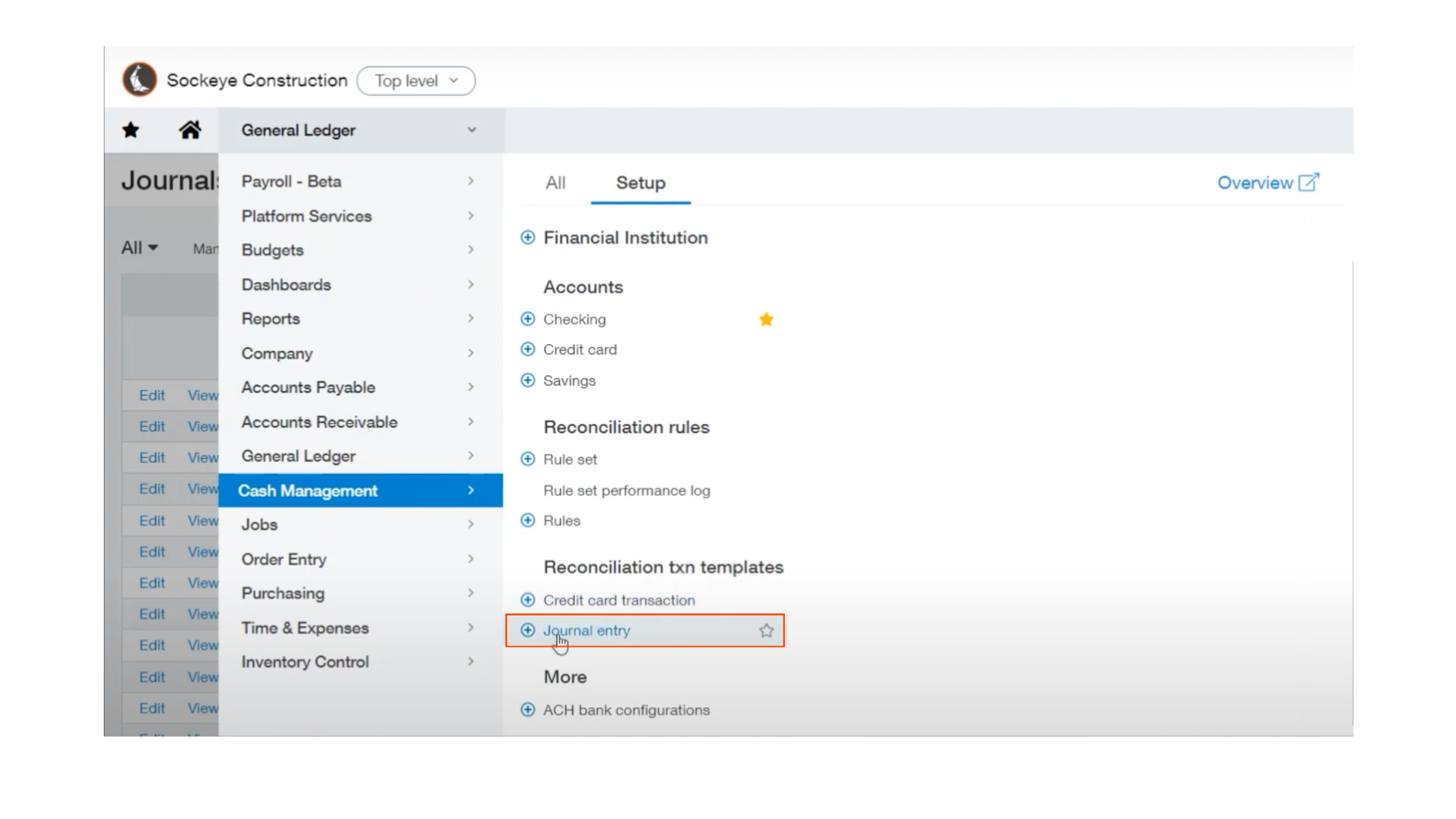

Navigate to: Cash Management > Setup > Journal Entry (under txn templates)

Select Add from the top right corner to set up a template. You may use the same template on both checking accounts as long as the offset account is the corresponding savings account.

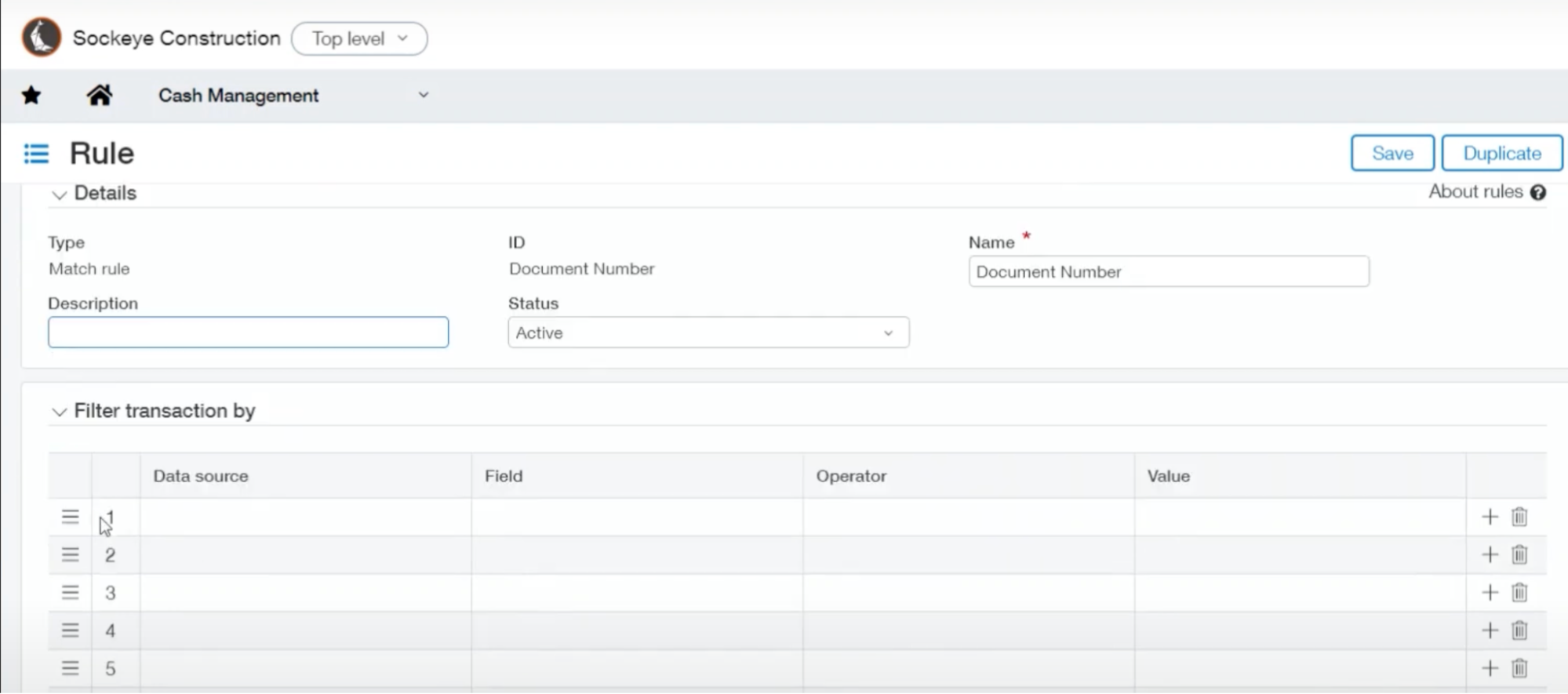

Step 3: Create the Rule

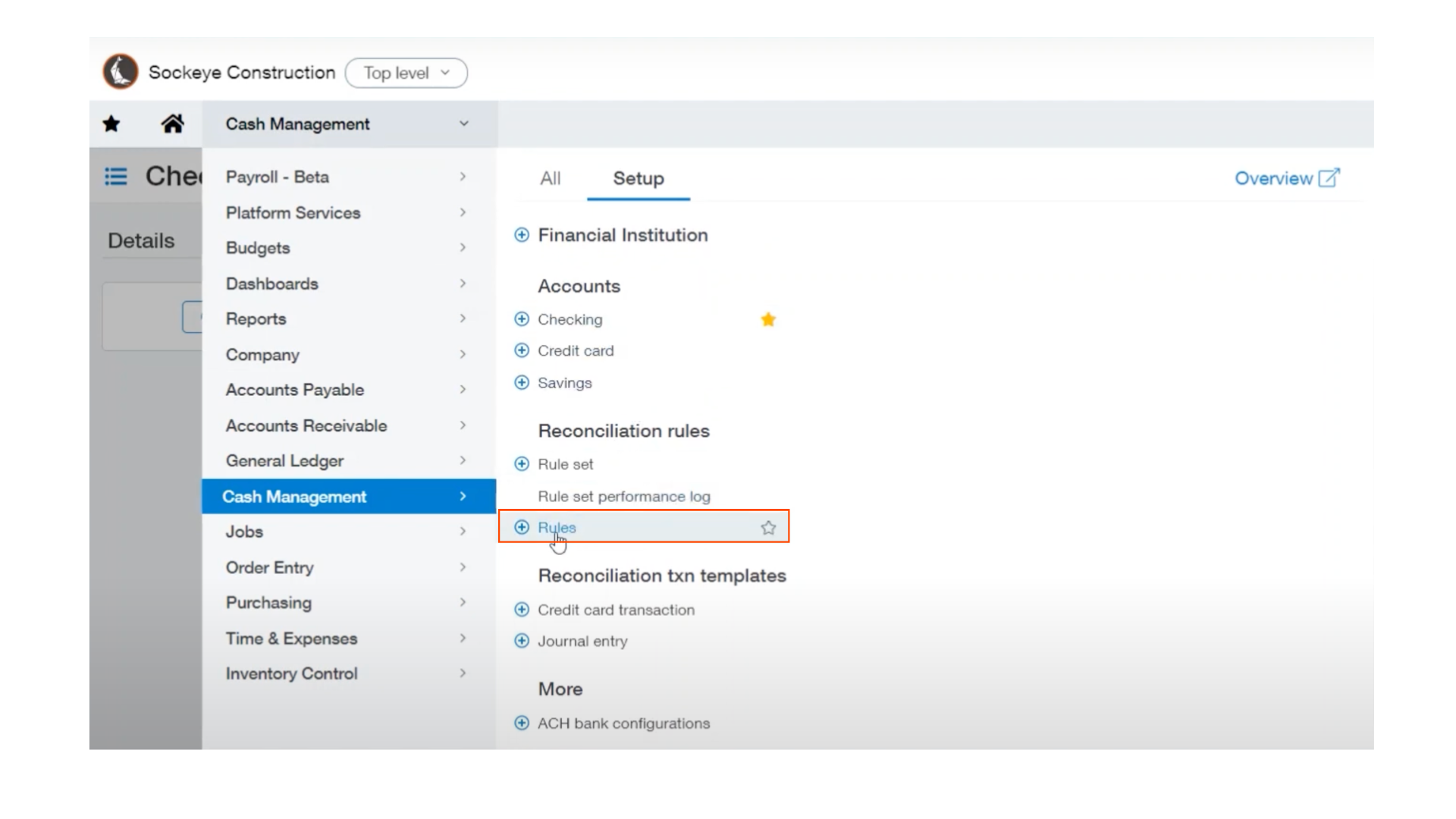

Navigate to the menu under cash management, choose Rules in the reconciliation rules category.

Cash management > Setup > Rules

You may add a new rule by selecting Add from the top right corner, and you may edit any rule by choosing Edit on the left hand side.

Intacct allows you to start by filtering transactions by data source, field, operator, or value.

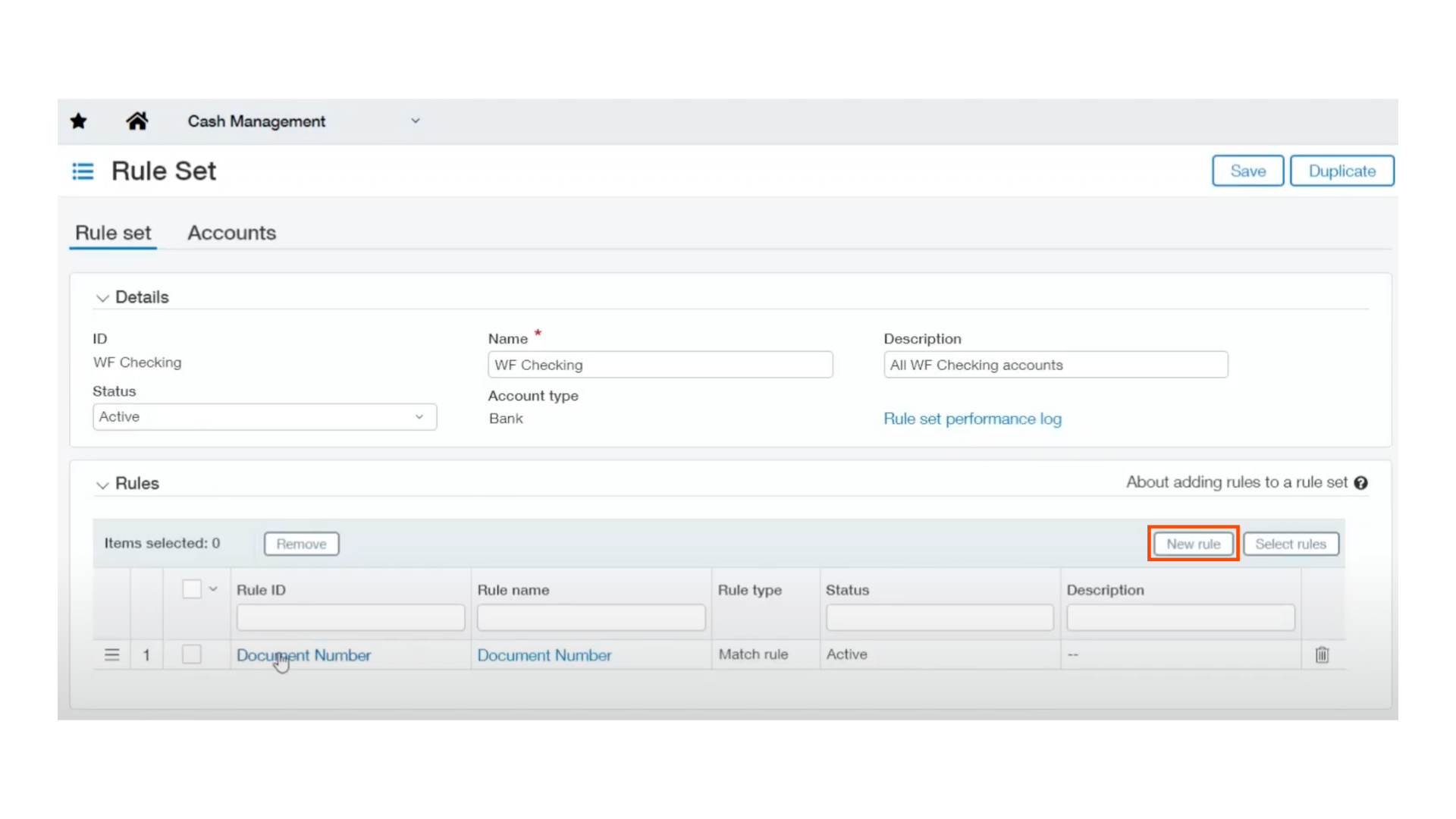

Once you have at least one rule saved, then you can go into your rule set and assign that rule to the rule set. Typically, a rule set is going to be a group of similar bank accounts from the same bank that are going to have the same rules. After the rule is established, transactions can start downloading from the bank and start feeding into Sage Intacct.

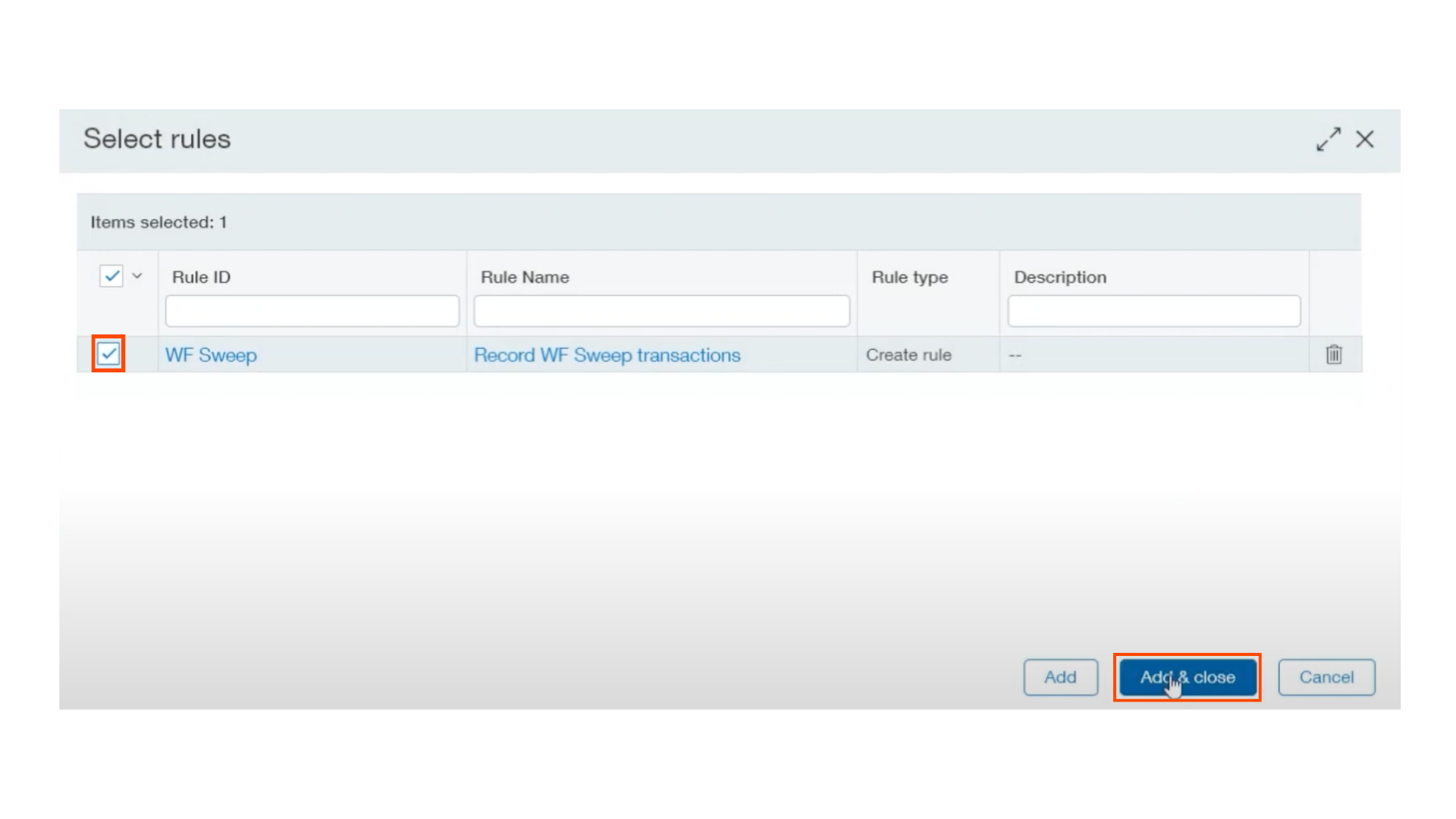

Step 4: Assigning the rule to the rule set

Cash management > Setup > Rule set

Choose to Edit the rule set that the checking accounts are using and select New Rule. Next, select the rule that you are assigning and Add it to the checking accounts. Remember to save your work.

Once this step is complete and Intacct connects it to the bank, it is going to back date to your set start date, and download all the transactions that follow that rule.

Checking Bank Sweep Status

To confirm your bank sweep status for a particular account, navigate to:

Cash Management > Setup > Checking

You can not only check the bank sweep status, but also the last transaction received for each account.

You may add this to a dashboard in your Intacct environment if necessary as well.

Overall, automating bank sweeps within your Intacct environment will increase accuracy and streamline an otherwise manual process. Additionally, it provides a true cash view for those consolidating bank accounts in real time.

If you have any further questions, feel free to reach out to one of our sockeye consultants.

About the author

Eric serves as one of Sockeye's owners and leaders. He is a brilliant problem solver and easily engineers accounting solutions as we build out products for our clients. Eric oversees our ERP department, providing direction for software solutions and client business processes. He sees projects from one thousand feet above and produces utilitarian implementations time and again.

Eric Ward, President

Watch the Video Overview of this Topic

View a video presentation on this topic here and browse through more Sage Intacct Tips & Tricks on our Video Insights page.