Upgrading From Microsoft Dynamics GP To Sage Intacct

Article by Eric Ward, President of Sockeye

If you’re a mid-market or larger business using Microsoft Dynamics GP and you have multiple entities, locations, or business divisions, then this might be the most important piece regarding financial software that you’ll read all year.

Many businesses are currently reliant on IT cost-intensive, on-premise accounting systems that, in the short run, are stifling productivity and increasing time and cost to maintain. In the long run, this creates an expensive, vulnerable and out-of-date ecosystem of reliance on 3rd-party IT consultants and value-added software resellers that can slow down the rest of your business.

As growing businesses begin to re-evaluate their current systems with the goal to upgrade to a more robust and modern solution, it’s important to weigh the benefits that a cloud-based system like Sage Intacct can provide, and objectively evaluate how it stacks up against Microsoft Dynamics GP in core areas like multi-entity accounting, dimension (segment) tracking, and analytics/reporting.

Multi-entity Accounting

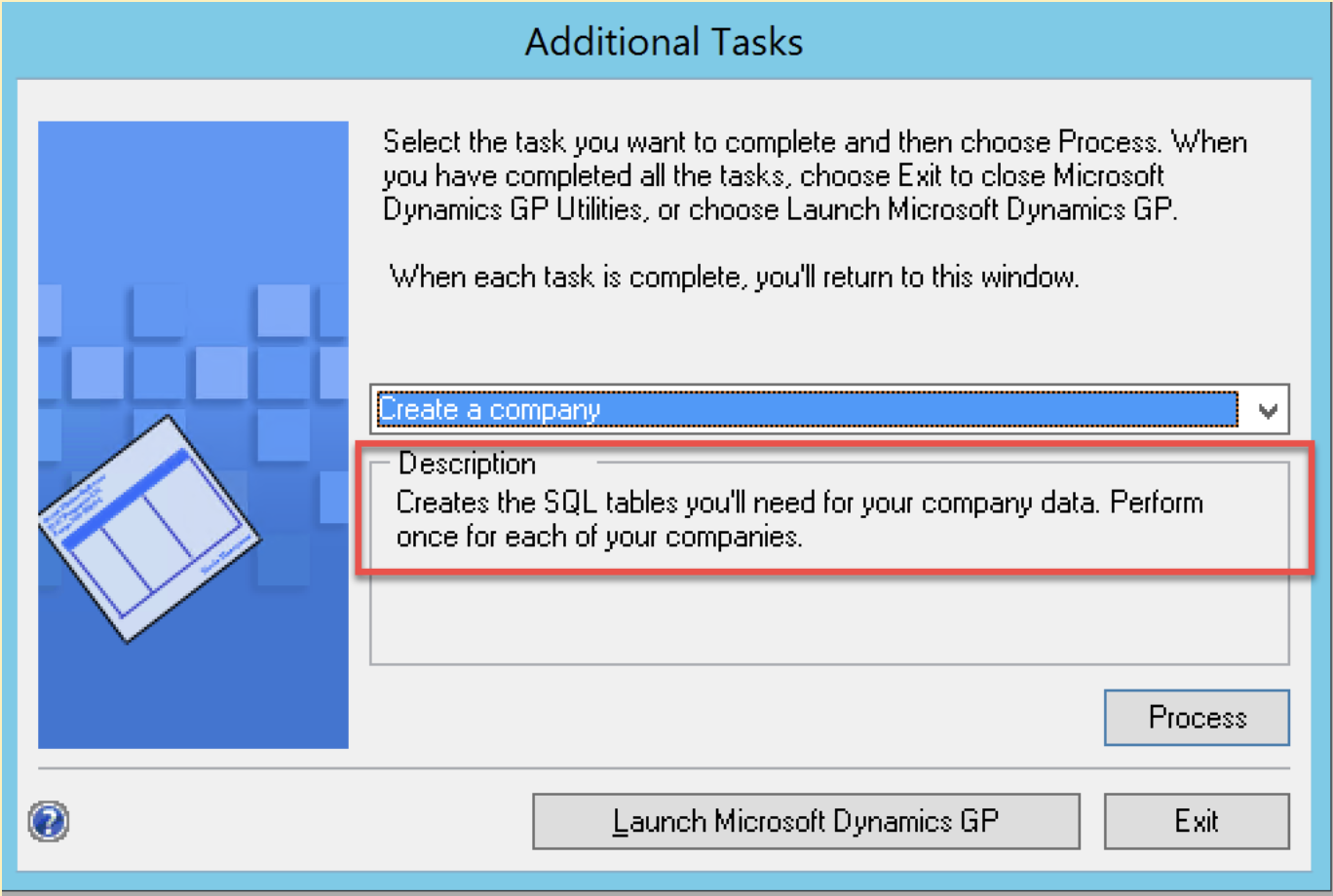

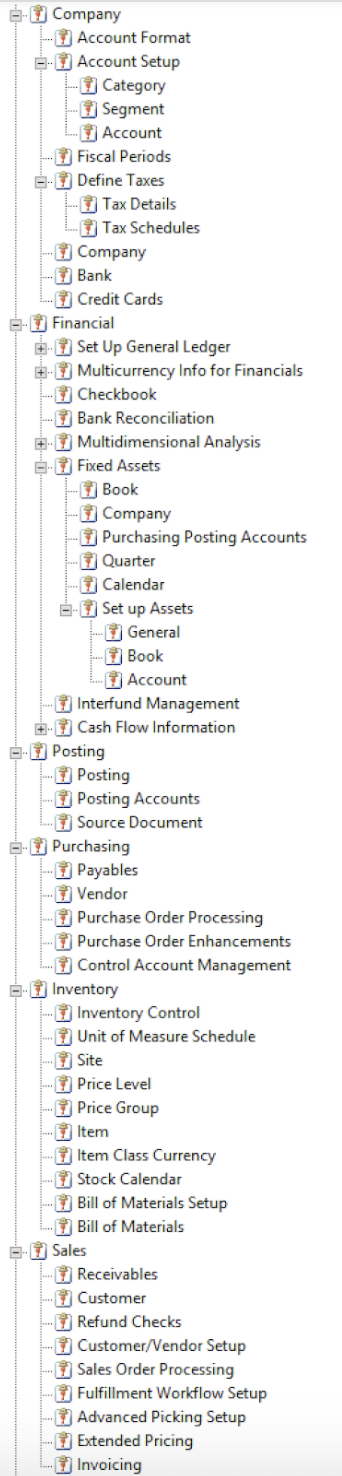

Microsoft Dynamics GP’s core architecture makes the creation and maintenance of a multi-entity structure unnecessarily clunky and challenging. Simply adding a new entity means creating a new database and having to reimplement the system for that new entity. Adding a new segment value (or even worse, a new segment altogether) - whether it be a location, division, or even a business unit - means hours, and often days, of setup and account mapping.

Creating a new company database in GP

This leads to a situation where you have multiple independent databases to maintain and update and in some cases can even lead to multiple servers with multiple on-premise instances of GP (if the GL Account frameworks are different). To make matters worse, there’s very limited ability for these entities to speak to each other unless you use 3rd party synchronization tools which can be extremely expensive to develop, implement, and support. When it comes time to consolidation, this can present highly complicated problems that can only be fixed by further reliance on external or 3rd party reporting software by value-added resellers or consultants.

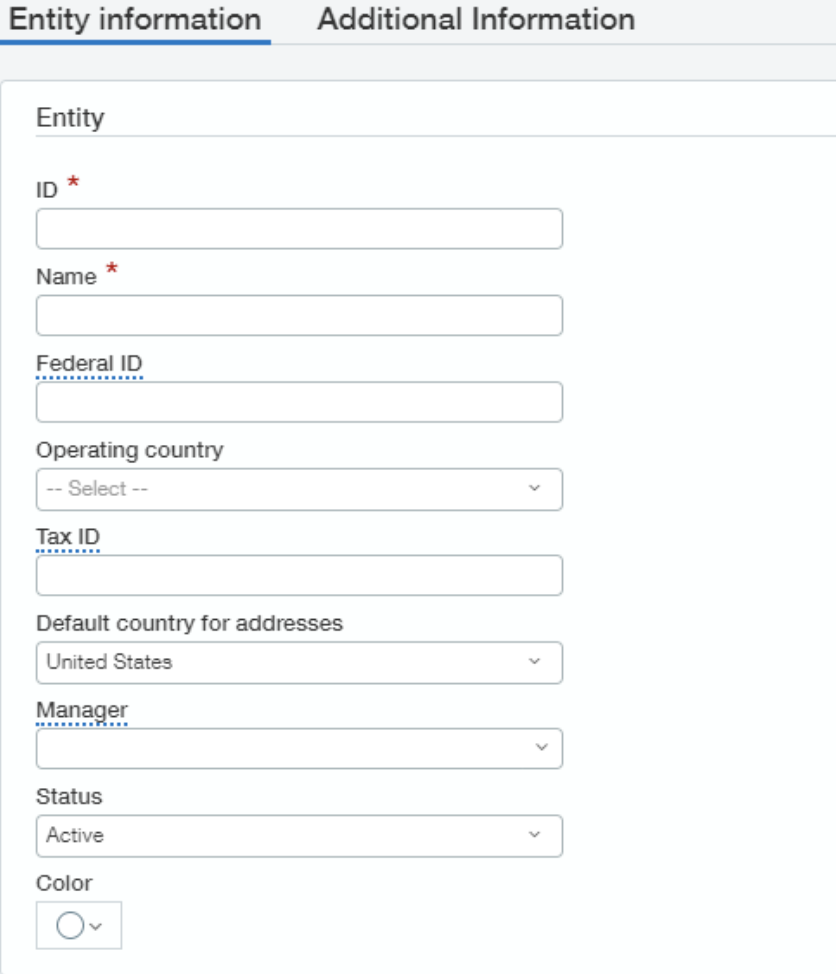

Sage Intacct’s unified multi-entity architecture emphasizes sharing definitions across different entities, making the whole exercise seamless and easy. At its highest level, you can create and configure how an entity should look and behave.

Required Items on the new company setup checklist in GP

Then, as you decide to add entities, you can set up the new entity to take advantage of the setup that has already been done for the others. Upon filling in a few fields, you can function in the new entity with the same setting as the others (if individual changes are needed, they can be updated).

You’re essentially “subscribing” new entities to a global setup, which allows you to have a shared chart of accounts, share customers/vendors, pool of currencies, and more. And with Sage Intacct’s robust consolidations module, with just one click you can run a multi-entity consolidation.

New company setup checklist in GP with optional setup items

Dimensions Tracking

Microsoft Dynamics GP doesn’t provide dimensions tracking out of the box. The problem is, GP and most other on-premise solutions rely on an outdated “hardcoding” structure when adding new accounts to the general ledger. In GP, this means adding segments (like dashes and 0’s) manually. This is not only cumbersome, but can lead to a long, confusing chart of accounts that can become very difficult to track and know exactly what values one is coding to when entering an account string. Additionally, it is difficult to combine segment values based on any attributes of the segment (such as all administrative departments). So, once again, value-added resellers need to come to the rescue with expensive software to enable custom fields or complex scripting to produce dynamic reports, that can change when your business changes. The problems don’t end there. Even with 3rd party implementations, all custom fields still need to be manually added to reports, and upgrading your system will require additional work on these customizations.

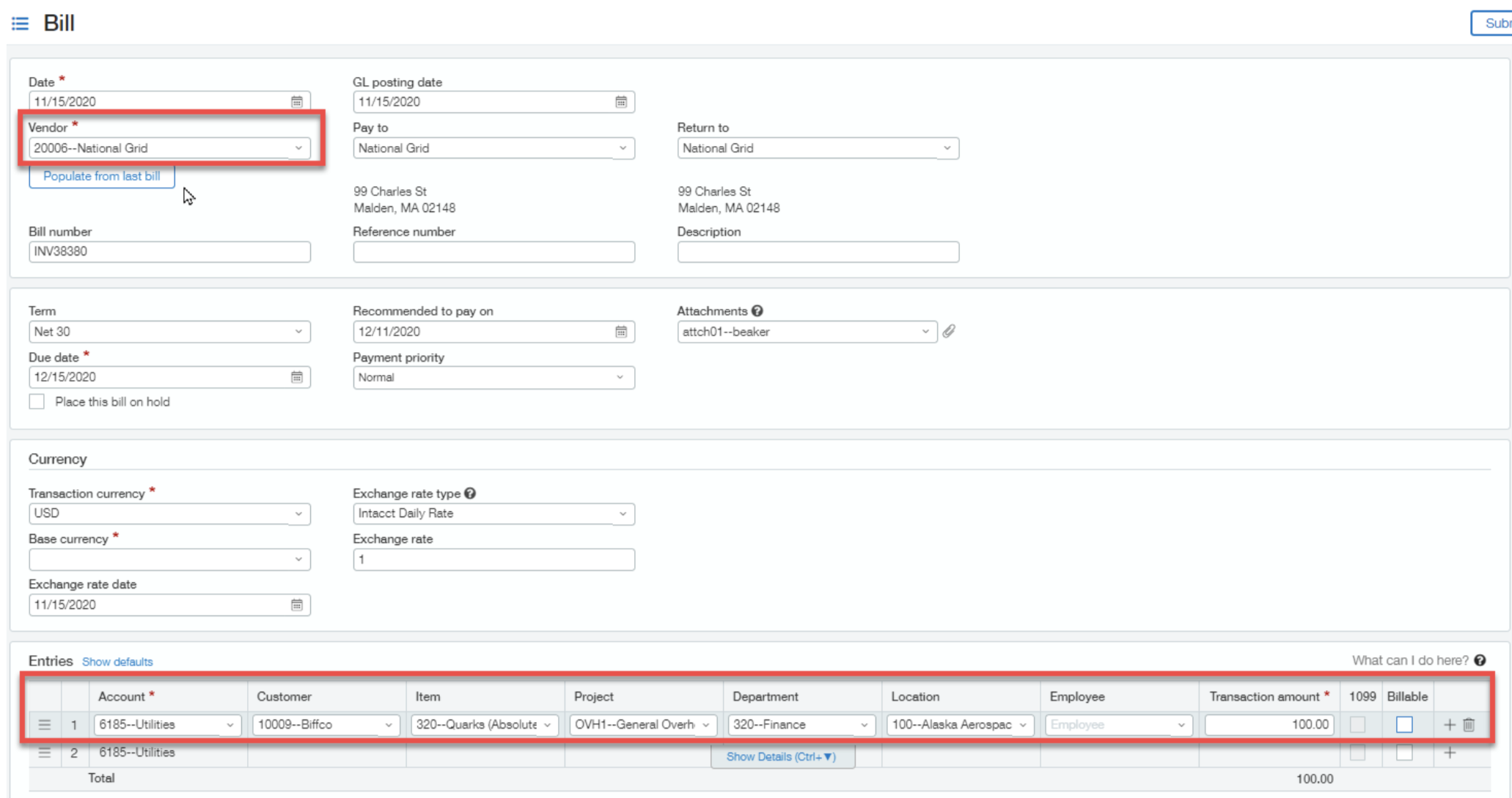

Sage Intacct’s Dimensions feature streamlines the tagging of transactions, and allows your business to view P&L in a powerful and unique way. When a transaction occurs in a subledger, you can easily tag that transaction with “dimensions” that are pertinent - like the vendor, customer, item, project, task, department, location, employee, GL account, and much more.

Sage Intacct’s Dimensions feature

Those same dimensions can be used to tag other transactions in the subledger, and everything gets automatically rolled into the general ledger. That way, you can produce reports that have revenue AND expense by the dimensions (i.e. P&L by vendor, P&L by customer, P&L by project, etc. instead of just seeing expense by vendor and revenue by customer) and actually drill down from the GL to get to the source document (the sales by line item for example). This level of visibility into your P&L lets you slice and dice your data by line items, categories, and in any way that’s important to your business.

Analytics & Reporting

Microsoft Dynamics GP provides basic financial reporting and dashboards that don’t update in real time - it has to be refreshed and maintained by scheduled refreshes or manually. Likewise, there are limitations on what can be shown on the dashboard. For more robust dashboarding, users must utilize programming-intensive 3rd party software like SQL Server Reporting Services or Power BI. For financial reporting, GP has a powerful Management Reporter feature - but it can’t be used for operational reports and is using a database outside of the GL to report on (i.e. it is not real time). Clients end up, once again, going to 3rd parties like Crystal Reports to build out operational reporting for their business.

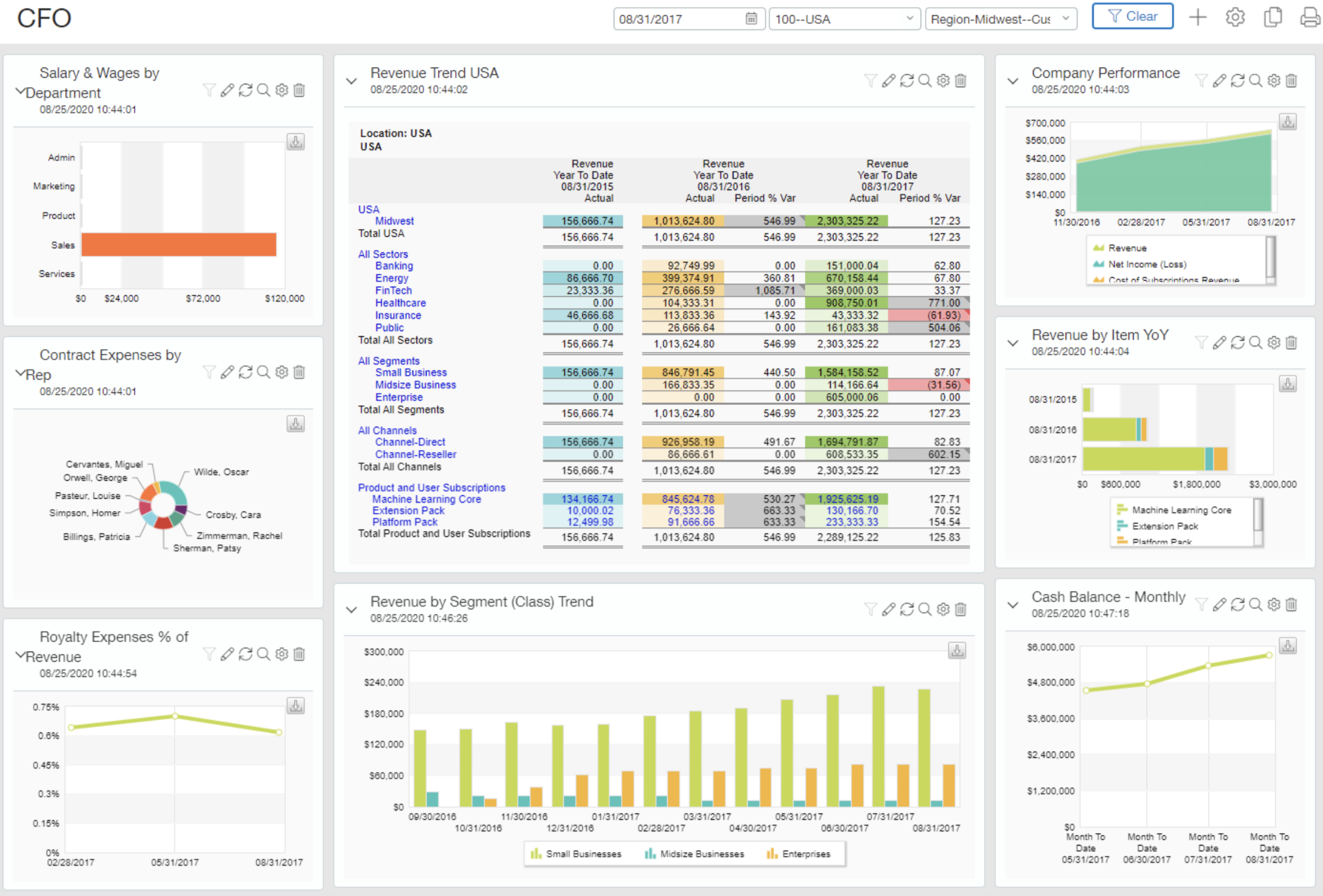

With Sage Intacct’s Dashboard feature, you can get real-time and truly customized insights in your business. It can easily be set up to show you living, breathing, financial and operating information as soon as you log in to your account. Whether it’s record views, cash balances, P&L reports, or charts and graphs, you can easily set it all up in your dashboard.

And then, with a single click, you can instantly drill down into that data - it’s all internally linked and visible. You can create KPIs, store analytics in the system, and even report on statistical accounts and track data to create the sales analytics dashboard that works for you.

Then, for reporting, Intacct comes packed with QuickStart Financials - up to 28 management, financial and operational reports depending upon your industry. These “canned” reports can be duplicated and/or edited for your needs. Creating custom reports is intuitive and easy as well; any user with access to the system can learn and develop their own reports without the reliance on any 3rd party software.

Sage Intacct’s Dashboard feature

Sage Intacct is a modern, cloud-based solution that drastically decreases total cost of ownership while unlocking growth and scalability for your business. There are no hardware costs, no upgrade costs, and no ongoing IT staff costs. And in return, your business will be able to increase productivity through unique insights into the business, real-time seamless tracking, and deep-level reporting out of the box.