Update From 1099-MISC to 1099-NEC Within Sage Intacct In 5 Easy Steps

Ryan Croxton, Senior Business Applications Consultant at Sockeye, recently discussed a big IRS change that’s about to hit businesses across the nation - and the 5 easy steps Sage Intacct users can take to prepare.

Effective starting the 2020-2021 tax year, the IRS is moving 1099-MISC box 7, titled “Non-Employee Compensation”, to a new form: the 1099-NEC.

Form 1099-NEC will now be replacing Form 1099-MISC for reporting non-employee compensation, meaning that 1099-MISC will be used to report other types of compensation. The change is primarily being made due to the administrative burden placed on the IRS to properly process the forms.

This presents an important dilemma for users of financial and accounting software, as it will require an update to most accounting software out there - including Intacct.

With the recent update to Release 3, Intacct has now added form 1099-NEC and box 1 as an option within Vendor Setup. However, 1099-MISC Form Box 7 will remain until Release 4 to give clients enough time to make necessary conversions.

As a result, Intacct clients will be required to update their existing 1099-MISC Box 7 vendors manually or via an Excel template.

Here are 5 simple steps to help address this change:

1

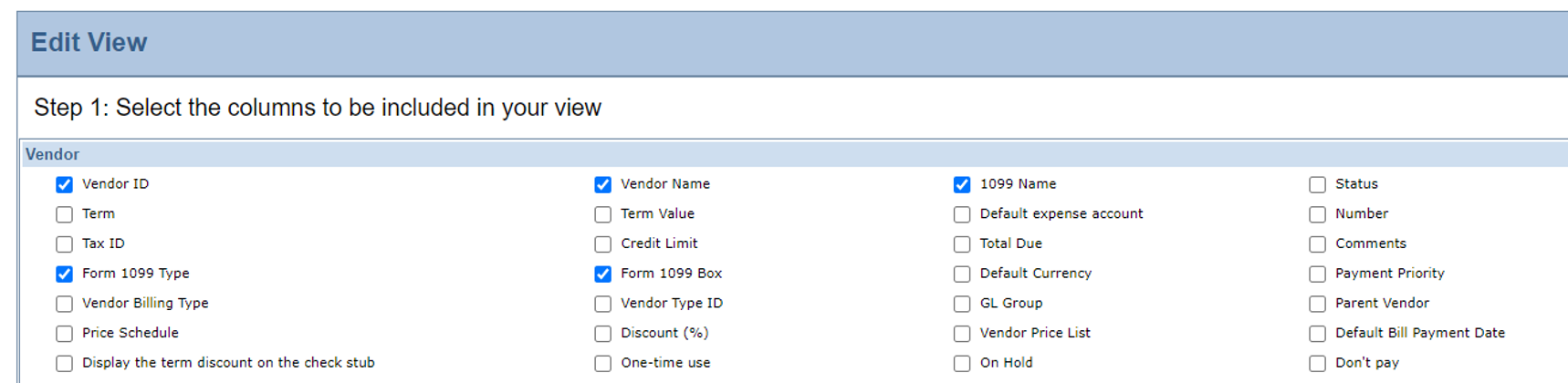

Create the 1099-MISC Export View

From the Accounts Payable module, go to Vendors, click on Manage Views, and click on Create new view.

This is a custom view that is created in the vendor listing in the AP module. The screenshot above displays the 5 columns to use for this view. The columns should be in the following order: Vendor ID, Vendor Name, 1099 Name, Form 1099 Type, and Form 1099 Box.

2

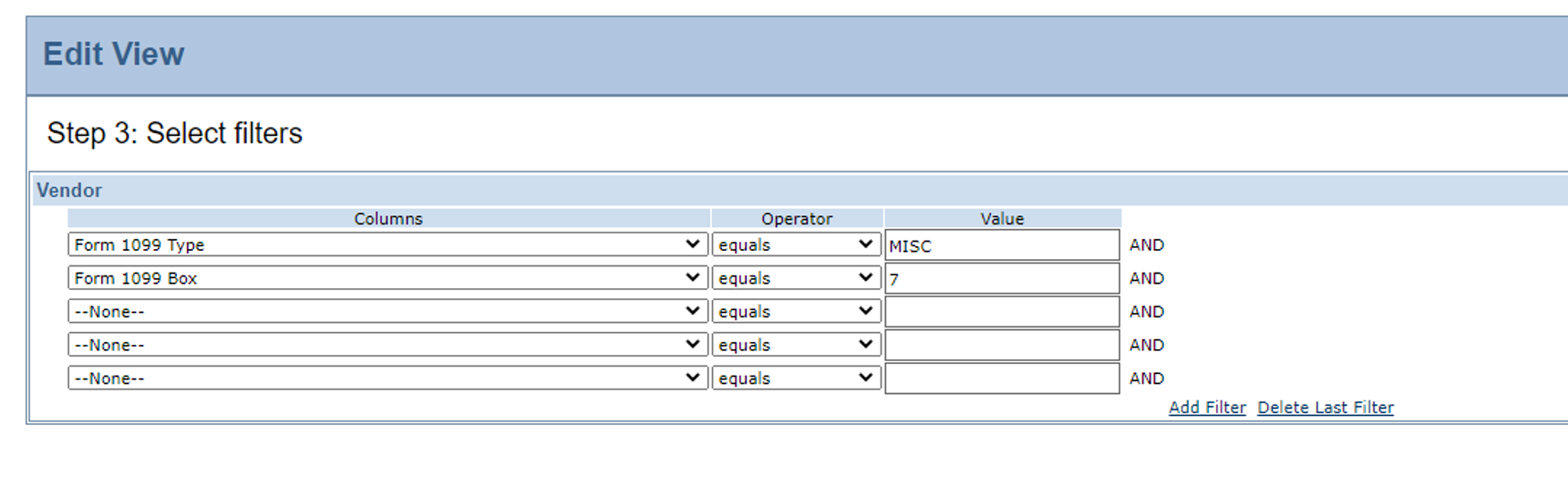

Filter The View

Now, filter the view by the following criteria (screenshot below):

- Form 1099 Type equals MISC

- Form 1099 Box equals 7

3

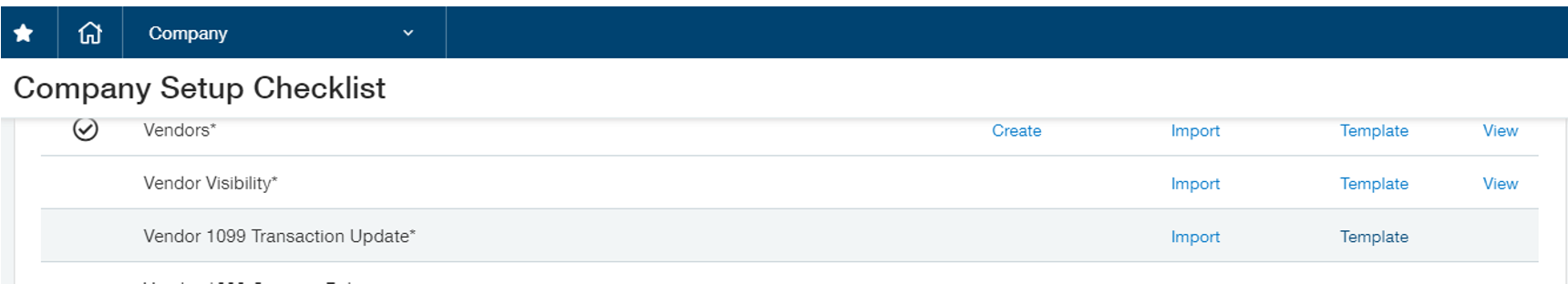

Create View, Export Results To Excel

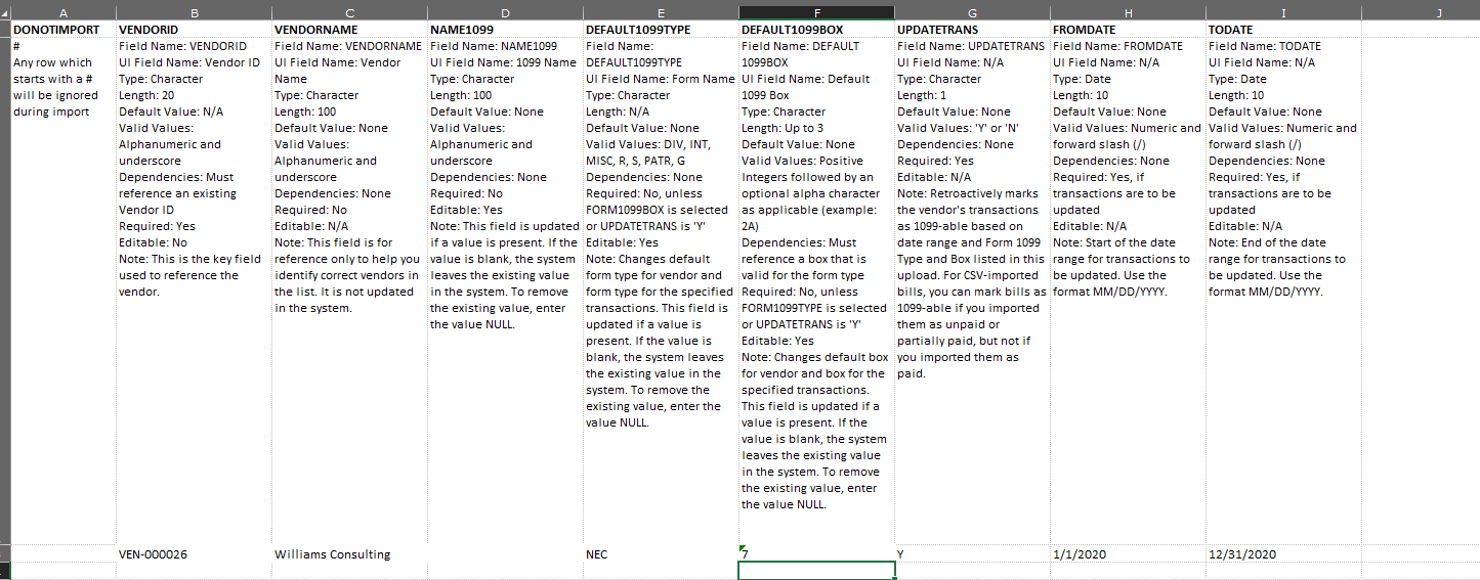

Once the view is created, export the results to Excel. The results can now be copied and pasted into the Vendor 1099 Transaction Update template that is found in the Company Setup Checklist.

Once the data is copied into the spreadsheet it should look like the example below.

4

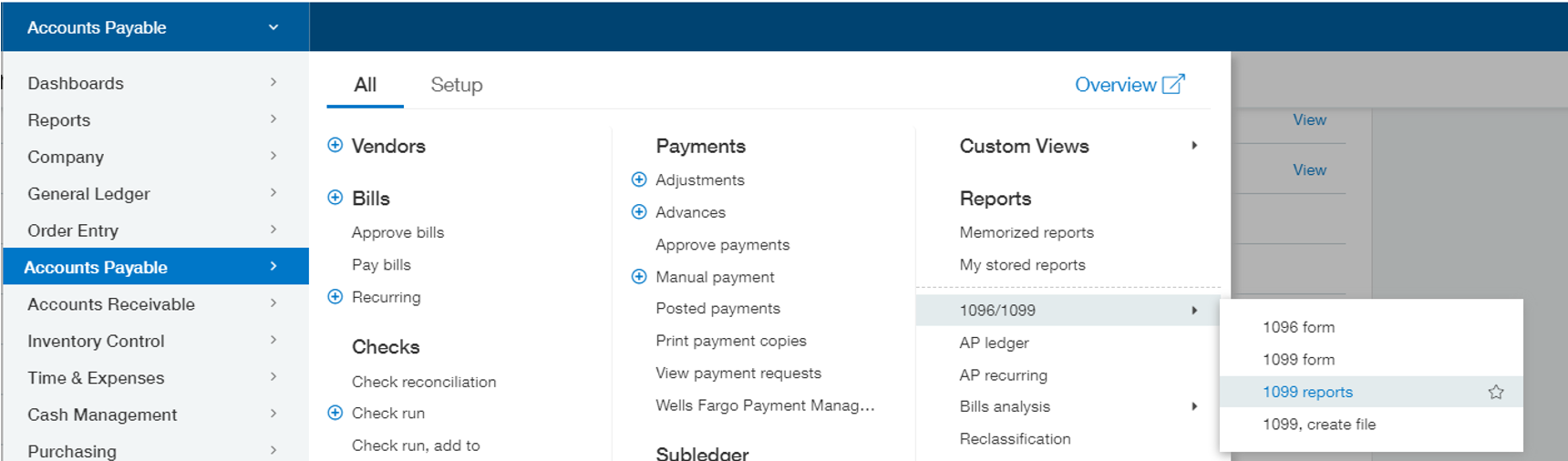

Run 1099 Report, Keep A Copy Of Results

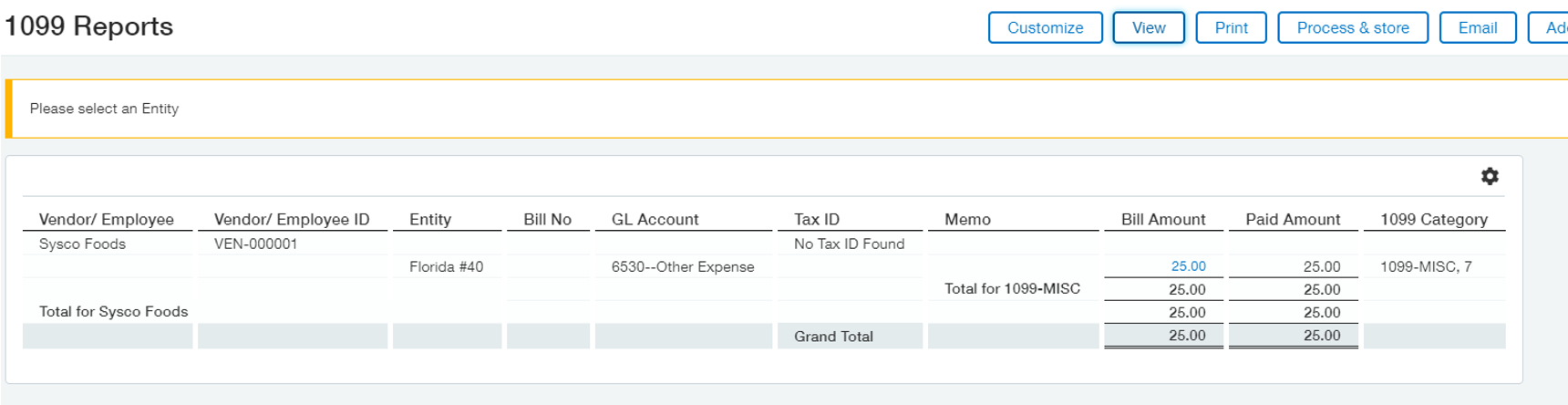

Prior to importing the 1099 update template, run the 1099 report for MISC-1099s and keep a copy of the results. This will serve as a check prior to the new file being imported.

5

Import Vendor 1099 Transaction Update Template

Once the import is successful rerun the 1099 report to ensure that the totals from the report in the previous step tie to the new 1099-NEC totals for box 7. This will ensure that no transactions were missed.

The 1099 MISC to NEC conversion process is now complete.

Sockeye is committed to ensuring that updates - no matter how big or small - are communicated to our clients in as simplified a manner as possible.

For any questions, please feel free to reach out to us at support@sockeyeconsulting.com.sockeye + sage intacct

Sockeye Announced as the 2019 Sage Intacct Growth Partner

Sage (FTSE: SGE), the market leader in cloud business management solutions, announced winners of the Sage Intacct Partner Awards for 2019. These awards recognize Sage Intacct channel partners that have achieved unmatched customer satisfaction, significant year over year growth, and extraordinary sales success.

Sockeye is a premier consulting firm and provider of cloud-based business solutions. In 2019, Sockeye achieved 142 percent growth as the result of targeting construction and government contractor vertical markets with precision and exceptional performance. The Sockeye team is focused on streamlining organizational processes, informing strategic decisions and meeting regulatory requirements while providing guided service for their clients.

“We are honored to be recognized as the Sage Intacct Growth partner for 2019. It has indeed been a year of growth. This recognition is a direct reflection of the trust our customers have put in us and the daily pursuit of our team to earn that trust,” said Nick Brorson, CEO of Sockeye.